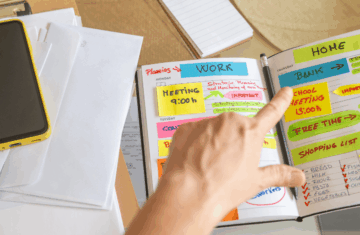

Effective bookkeeping is a cornerstone of small business success. It’s not just about tracking numbers; it’s about gaining insights into your business’s financial health and guiding strategic decisions.

This expanded checklist provides small business owners with detailed steps to maintain comprehensive and effective bookkeeping practices.

Regular Financial Record Maintenance

Consistently update and maintain all financial records. This includes logging every transaction, keeping receipts, recording invoices, and tracking expenses. Accurate records are key to understanding your business’s financial state and are crucial for year-end tax preparations.

- Implement Systematic Recording: Utilize bookkeeping software or manual systems to regularly record transactions.

- Organize Documentation: Keep all financial documents well-organized for easy access and reference.

Accurate Invoicing and Receivables Tracking

Develop a robust system for managing invoices and tracking receivables. Quick and accurate invoicing, coupled with effective follow-up on late payments, is essential for maintaining cash flow.

- Timely Invoicing: Ensure invoices are issued promptly after services are rendered or products are sold.

- Monitor Receivables: Regularly check outstanding invoices and follow up with customers to ensure timely payments.

Diligent Expense Recording

Record and categorize all business expenses diligently. This process not only helps in keeping track of spending but also aids in identifying tax-deductible expenses.

- Categorize Expenses: Properly categorize each expense to maintain clarity in financial statements.

- Review Regularly: Periodically review expenses to identify cost-saving opportunities and budgetary adjustments.

Bank Account Reconciliation

Monthly bank reconciliation is crucial. Compare your bookkeeping records with bank statements to ensure consistency. This helps in catching errors or unauthorized transactions early.

- Reconciliation Process: Match each entry in your bookkeeping records with corresponding bank transactions.

- Identify Discrepancies: Promptly investigate and rectify any discrepancies found during reconciliation.

Payroll Management

If your business has employees, manage payroll meticulously. Ensure accurate calculations of salaries, tax withholdings, and superannuation contributions.

- Regular Payroll Audits: Conduct regular audits to ensure payroll accuracy and compliance with employment laws.

- Maintain Confidentiality: Keep payroll records confidential and secure.

Inventory Management (if applicable)

For businesses with inventory, precise record-keeping is essential. Regular stocktakes and inventory valuation help in understanding product turnover and profitability.

- Conduct Regular Stocktakes: Regularly count and value inventory to ensure records align with physical stock.

- Assess Inventory Health: Analyze inventory levels to optimize stock and reduce holding costs.

Financial Report Preparation

Periodically prepare and review essential financial reports. Profit and Loss statements, Balance Sheets, and Cash Flow statements provide insights into your business’s financial status, guiding informed decision-making.

- Understand Report Implications: Learn to interpret what these reports indicate about your business’s financial health.

- Use Reports for Strategy: Utilize these insights for strategic planning and identifying growth opportunities.

Tax Preparation and Filing

Stay informed about your tax obligations and prepare accordingly. Accurate bookkeeping simplifies tax filing and helps in identifying potential tax deductions.

- Understand Tax Requirements: Be aware of relevant taxes and filing deadlines for your business.

- Seek Professional Advice: Consider consulting a tax professional for complex tax matters or planning.

Budgeting and Financial Planning

Engage in proactive budgeting. Regularly compare actual financial performance against budgeted projections to manage resources effectively and plan for future growth.

- Set Realistic Budgets: Create budgets based on historical data and future projections.

- Adjust as Necessary: Be flexible to adjust budgets in response to business changes or unforeseen circumstances.

Regular Review and Adjustment

Continuously review and adapt your bookkeeping practices. As your business evolves, your bookkeeping needs may change. Staying adaptable ensures your financial management remains effective.

- Assess Bookkeeping Efficiency: Regularly evaluate the effectiveness of your current bookkeeping system.

- Implement Improvements: Stay open to adopting new tools or practices that can enhance bookkeeping efficiency.

Bookkeeping is an ongoing journey that requires diligence, accuracy, and adaptability.

By following this comprehensive checklist, small business owners can ensure their finances are well-managed, paving the way for informed decision-making and sustainable growth.

Empower your small business with effective bookkeeping practices. For additional guidance or to explore bookkeeping solutions tailored to your business needs, consider reaching out to professional Bookkeepers or financial advisors.